Here Are The 20 Best Income Portfolios Built with ETFs for 2023

If you're looking for income then you should look at this list of the 20 best income portfolios.

Charles Schwab’s target-date portfolios are one-stop funds. They are exposed to between 70% to 95% stocks and 5% to 30% bonds. They can be built with 8 ETFs.

Below you can see the historical return of Charles Schwab target-date portfolios.

Portfolio data was last updated on 11th of August 2023, 08:35 ET

| Name | Year to date | Return in 2022 | 10 year return | CAGR since 1989 (%) | Draw Down | Expense ratio | Yield |

|---|---|---|---|---|---|---|---|

| Schwab Target Date Index Fund 2030 | 8.61 | -15.52 | 6.89 | 7.9 | -24.29 | 0.05% | 2.25 |

| Schwab Target Date Index Fund 2040 | 10.48 | -16.51 | 7.97 | 8.39 | -31.01 | 0.05% | 2.24 |

| Schwab Target Date Index Fund 2050 | 11.56 | -17.07 | 8.57 | 8.65 | -35.06 | 0.05% | 2.24 |

| Schwab Target Date Index Fund 2060 | 12.08 | -17.35 | 8.86 | 8.77 | -37.12 | 0.05% | 2.24 |

Here is what the table is showing you

Year to date: This shows what the portfolio has returned this year starting from the first trading day of the year.

10 Year return: This shows the compounded annualized growth rate over a ten-year period. The current year is excluded from calculations.

CAGR since 1989: This shows the compounded annualized growth rate since 1989. The current year is excluded from calculations.

Expense ratio: This shows the cost of holding the portfolio if you were to construct the portfolio using the proposed ETFs.

Yield: This is the expected dividend yield of the portfolio.

Please note that past performance is not a guarantee of future returns.

Below you can see the returns of the best portfolios that we have benchmarked.

| Name | See Portfolio | Year to date | Return in 2022 | 10 year return | CAGR since 1989 (%) | Draw Down |

|---|---|---|---|---|---|---|

| Ben Stein Retirement | Coming soon! | 4.05 | -18.03 | 9.46 | 10.8 | -35.42 |

| Paul Merriman 4-Fund-Portfolio | Coming soon! | 9.22 | -11.98 | 11.25 | 10.38 | -35.26 |

| S&P 500 | Coming soon! | 17.09 | -18.19 | 12.52 | 10.28 | -37.63 |

| Paul Merriman Target Date Portfolio (25 year old) | Coming soon! | 6.63 | -13.08 | 8.28 | 10.2 | -36.46 |

| Scott Adams Dilbert Portfolio | Coming soon! | 10.87 | -18.75 | 7.0 | 10.19 | -44.88 |

| JL Collins, Simple Path To Wealth, Wealth Building Portfolio | Coming soon! | 16.6 | -19.51 | 12.08 | 10.19 | -37.0 |

| American Institute of Individual Investors (AAII) Portfolio | Coming soon! | 3.74 | -13.91 | 9.7 | 10.16 | -40.85 |

| Paul Merriman Target Date Portfolio (35 year old) | Coming soon! | 6.57 | -13.22 | 8.31 | 10.08 | -36.35 |

| Assetbuilder.com Portfolio 14 | Coming soon! | 6.95 | -16.94 | 7.59 | 9.99 | -37.91 |

| Balanced Portfolio 90/10 | Coming soon! | 14.83 | -18.87 | 11.03 | 9.84 | -32.78 |

This is the allocation for Schwab Target Date Index Fund 2050.

Charles Schwab founded his business in 1971 and the company he founded is now one of the largest banks with a brokerage and an ETF business.

Schwab brokerage offers to manage your portfolios according to your risk level using a number of portfolios. Schwab also offers one-fund target-date retirement funds. The Charles Schwab story is interesting in itself and is vividly described in Charles Schwab: How One Company Beat Wall Street and Reinvented the Brokerage Industry.

A man who trims himself to suit everybody will soon whittle himself away.

– Charles R. Schwab

The Charles Schwab Corporation is a giant within asset management. They hold $4.04 trillion in client assets. Charles Schwab Corporation operates as a bank, a wealth manager and a brokerage.

The company was founded by Charles R. Schwab. His main intention was to provide low-cost investing to the masses.

Charles Schwab (the man) has written a number of good books.

I’m only going to recommend one here. It is called Charles Schwab’s New Guide to Financial Independence Completely Revised and Updated: Practical Solutions for Busy People. It deals with the hows to managing personal finances and it deals with how to invest.

When a man has put a limit on what he will do, he has put a limit on what he can do.

On a personal note, I admire Charles Schwab a great deal for his foresight and his magnitude of thinking.

These portfolios are Charles Schwab’s target-date funds. They can be bought as one-fund solutions at a very cheap price.

Their portfolio composition is simple and elegant with high returns. When I dived into these I thought that they were rather unspectacular, bland, and unnoteworthy. That is their advantage, however.

They do suffer from the always-hold-bond syndrome that so many target-date funds are afflicted with.

Holding bonds for 40 years is a sub-optimal way to invest for investors.

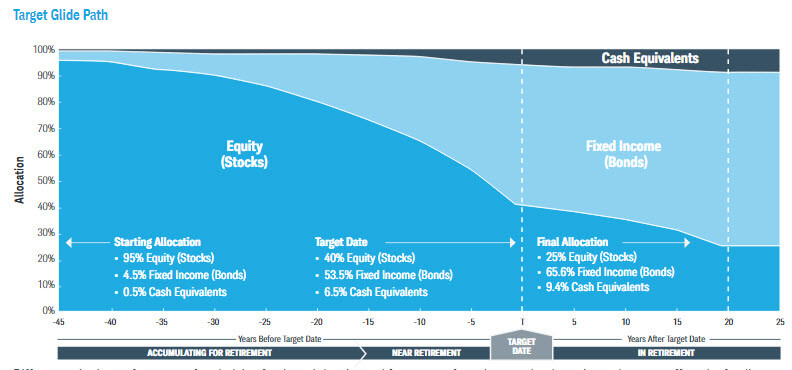

Disclaimer: These are target-date funds. By design, their asset allocation will change over time. In general, target-date funds shift more of their assets towards bonds as you age to lower your risk. This means that the asset allocation below will have changed until we update it here at portfolioeinstein.com. You can see a graphical of the glide path below.

The information on these funds was collected in 2018.

Source: Charles Schwab, statutory prospectus for target-date index funds.

Source: Charles Schwab, statutory prospectus for target-date index funds.

Note! Please check the fund prospectus for the exact asset allocation and funds to use.

If you bought these one-stop funds at Charles Schwab they would contain Schwab ETFs. We for the most part recommend Vanguard ETFs due to their cheaper cost and higher volume. Schwab ETFs are very good, however.

You can compare different Target Date Funds in the article What Is The Best Target Date Fund?

Get a primer on target-date-fund in our article Target Date Fund Portfolios.

Charles Schwab has a good youtube channelwith lots of useful information.

If you have already committed to a portfolio then maybe you need help maintaining the portfolio. In this case you will find our rebalance worksheet useful.

Rebalancing your portfolio lowers your risk and may provide higher returns in the long run. It is completely FREE.

You can find the rebalance worksheet in our article Here Is The Most Easy To Use Portfolio Rebalance Tool.

Nothing special happens the after target date has been passed. The funds will still exist. The asset allocation at that point is, depending on the provider, is around 50% bonds, and 50% stocks.

Some target-date funds are too conservative because they allocate too much to bonds. When you are in your 30’s and 40’s you do not need bonds in your portfolio. Many target-date funds have allocations to bonds at this stage. Stocks perform better than bonds over the Long-Term.