Do you want a surefire way to how to invest money? Do you want to get investing right on the first try? Having a robust framework to guide your first baby steps in investing is crucial to keep you motivated and engaged so you can reach your goals.

Have you been told investing is only for professionals?

Have you been told investing is hard?

Have you been told investing will make you lose money?

Let me tell you right now that this is wrong, wrong, and wrong.

I’ll guide you through the first five steps you need to take to get a good point of entry into the investment world. Investing is only hard if you let someone tell you it is.

When you have read the article, you will know:

- Why you need to invest

- How you can consistently invest better.

- What you should do going forward.

Let’s get started with Portfolio Einstein’s How To Invest Money guide!

Step 0: How to invest money means how to save money

Ok, so I cheated by adding a step 0. I’m sorry, but you certainly won’t be when I’m done. I promise. Step 0 is just a primer about savings. I’ll make it short and worth your time.

To get started with investing, you need cash. So saving is the name of the game. I usually recommend putting 10% aside from net income. This is not always possible, but don’t let that stop you. If you can only spare 1% then put 1% aside. Every little bit helps in the long run. As long as you’re doing something, you’re on your way to reach your goals.

Ten dollars a month is 120 dollars in one year. That’s 120$ that you didn’t have when you started. Put the savings in a separate account that you don’t see every day.

Having savings is immensely important. Savings gives you options, builds confidence, and ultimately give you F.U. money if that’s the route you want to take.

Saving money is also the most important thing when you are starting to invest. This is because the compounding effect of investment returns kicks in after 10+ years.Getting a 10% return on $100 is $10 but getting a 10% on $100,000 $ is $10,000 – now we’re talking! The more you can save, the more money will be able to compound over time.

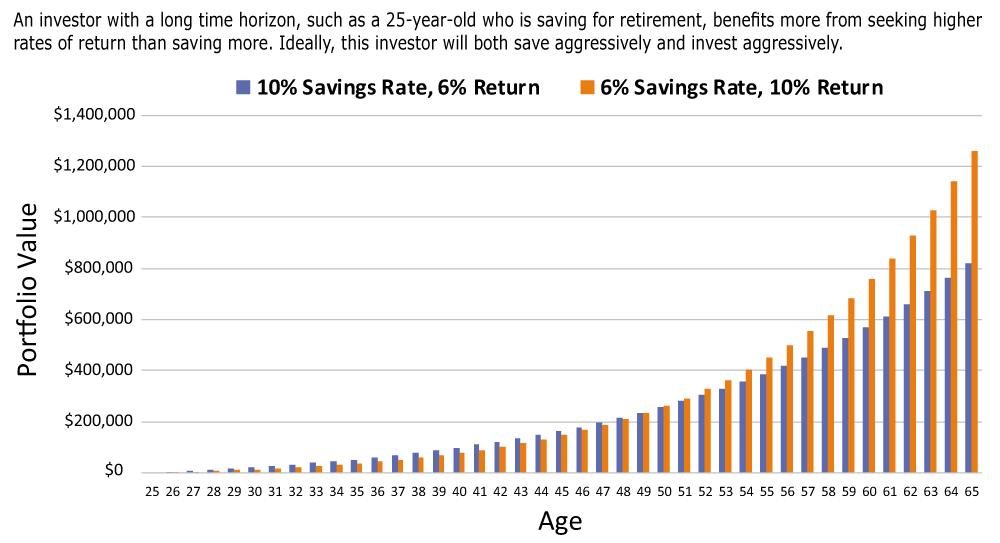

Meb Faber recently made a post about savings vs. returns.

He compared two scenarios:

- Getting a return of 6% and saving 10%.

- Saving 10% and getting a 6% return.

Graph showing the importance of saving early. Source: mebfaber.com

Only after 25 years does the second scenario (higher returns) surpass the higher savings scenario.

Step 1: How to set goals the right way

If you don’t have any goals, you’re already there. Goals don’t have to be super specific, but mentally this helps. You could have a goal to save 10% and see where that leaves you.

You need a plan and goal. However, as Mike Tyson stated:

Everyone has a plan until you get punched in the face

– Mike Tyson

Prepare for your plan to get sidetracked, demolished, and changed, but failing to plan is planning to fail. You need a plan.

If I always appear prepared, it is because before entering an undertaking, I have meditated long and have foreseen what might occur. It is not genius which reveals to me suddenly and secretly what I should do in circumstances unexpected by others; it is thought and preparation

– Napoleon Bonaparte

When John F. Kennedy, in 1962, proclaimed that the USA would put a man on the moon at the end of the decade, there was no plan, but there was a goal. A plan was quickly formed, however.

You need to have a goal to make your plan.

You need to have a plan to get to your moon.

The goal is a specific outcome, financial or otherwise. The plan is a series of actions that will get you there.

Types of goals include:

- Saving for retirement

- Saving for college

- Family trip to the Fiji island

- Getting a new car in 5 years

- Getting a new car in 10 years.

How you invest money is as much to do with practicalities as to why you invest money.

How to invest money for the iPhone you will buy in 21 years

The possibilities are endless when you start setting goals and especially financial goals. An excellent tool for helping you set financial goals is YNAB. It’s a personal finance tool that I use every day. It inspired me to make a super nerdy spreadsheet that attempts to list ALL the financial goals that I will encounter in my life till the day I die.

This is a fun exercise to do (at least for me!) and shows the power of savings and compounding returns.

Let’s say I want to save for a new mobile phone that I will buy in 21 years. (I know I’m going to need a mobile phone in 21 years, why not start saving for it?)

I’ll set my price for the mobile at 1000$ (it’ll be a lot more due to inflation). Using Bankrate’s saving calculator, I need to put 2.54$ aside every month at 4% interest.

You can do this for all the things in your future life, not just your big-ticket purchases. From the day we’re born, we already have expensed coming our way. Why not plan for them and let the power of savings and compounding help us out?

Paul Merriman has a great article showing you how to turn $3,000 into $52 million by thinking ahead and putting savings and compounding to good use.

Helpful tools that will set goals for you.

If you need to calculate how much money you will have in x amount of years, use a calculator.

This one from Bankrate lets you calculate how much you need to set aside each month to save for your goal.

For example, to save $10,000 in 5 years (for your dream vacation) at 4% returns, you need approximately to set 150$ aside each month.

You can also do this in Excel using the PMT function.

A critical note about financial goals

If you need the money within five years, it is prudent to invest the money very conservatively. This means putting the money in a:

- Money market fund (VMMXX from Vanguard is good)

- A CD (certificate of deposit)

- A short-term bond ETF or fund, for example, SHY, BSV. If you have 3+ years, it would be sensible to put them in a longer duration fund such as AGG or BND

- A portfolio with a substantial weighting towards bonds – at least 50%.

Let’s get your money working for you next.

Step 2: How to pick the right investment account

You need an investment account at a broker, mutual fund, or bank. Depending on where you are in the world, either one of those will do. Here’s what you need to be aware of when selecting the right one:

- It needs to have low fees. That means small commissions (max $10 per trade) or even free. It shouldn’t cost a dime to transfer funds in or out of the account. They should be open about their prices on currency conversion.

- You should not be paying anything for having a portfolio at your broker or bank. Banks often charge a fee for holding your assets. This is an unnecessary expense.

- It needs to offer the right funds and ETFs. Make sure you can get Vanguard ETFs and mutual funds, iShares ETFs, or Schwab ETFs

- It needs to be respectable. Don’t go with brokers or banks that are just getting started or have dents in their reputation. It is not worth it, even if they are much cheaper!

- Consider using robo-advisors. Brokers such as Betterment and Wealthfront are excellent choices for your investments. Their portfolios are excellent, and they offer complementary services that add value.

- Beware of bling. Many brokers and banks offer what I call bling services. Services that provide nothing more than extracting wealth from your savings. You need the basics covered first: Able to buy ETFs at a low cost. Automation such as auto purchase, auto-rebalancing, portfolio analysis etc. is bling. Don’t pay for it when you’re just getting started. Later, when you have a good idea of what you’re paying for, you can check out the offerings. The exceptions are certain robo-advisors such as Betterment and Wealthfront, which has the bling built-in.

- Make sure the bank or broker provide some kind of help with your taxes. They almost all do this through various yearly statements and overviews.

Next up, the fun stuff – picking the right portfolio.

Step 3: How to pick the investment portfolio to reach your dreams

Now comes the fun stuff! Picking the right portfolio.

Depending on your time horizon, the portfolio you choose will vary wildly. A 25-year-old saving for retirement has a very different portfolio requirement than a 42-year-old saving for a family holiday in 5 years.

At portfolioeinstein.com, we have a lot of portfolios. Many of them are totally unsuited for your purpose. But many are very suitable. So which ones do you pick?

Standard what motion?

The first parameter you need to look at is the standard deviation. That’s the risk of the portfolio. This shows you how much the returns will likely vary from year to year. The higher the standard deviation, the more the returns will bounce around. A portfolio with an average return of 1% and a standard deviation of 1% will vary its returns by 1% from year to year – on average. So a $100 savings portfolio with a 1% standard deviation is expected to move up or down by $1 each year.

The standard deviation describes the probability of how volatile the returns will be in a given year. The returns are distributed along with a bell curve graph. This means that 68% of the time, the returns will be within one standard deviation, 95% of the returns within two standard deviations, and 99.7% of the returns within three standard deviations.

See this post for the same take on it.

So when looking at the volatility (std), remember that you will experience those swings quite often.

The next metric is the drawdown.

This is the maximum amount the portfolio has historically lost in a year. In my opinion, this is a better metric of risk than standard deviation is. Note that the drawdown is measured at the year’s end. The drawdown in mid-year could actually be higher. This was the case for the S&P 500 in 2009 where it had bottomed out losing a total of 50.8% since 2007. In a single year, however, the S&P 500 has “only” lost 37%. It has since regained what it lost during those years and gained a massive 250% since then.

The drawdown metric is very important as not many investors can stomach a drawdown of more than 25%.

The final metric is the return metric. This is a dazzling statistic, and that which what everyone looks at first. But the risk metrics are more critical as you will not get the returns of the portfolio if you don’t stick with it.

The best portfolio is the portfolio you can stick with.

Picking the right investment portfolio

If you have a goal ready, you know how much time you have. Using the Bankrate calculator, you will know the approximate amount of returns you need to achieve your goals. That will help you in deciding what level of risk you should take. There is no need to take more risk than you need to!

If you are unsure about which portfolio to choose Portfolio Einstein recommends you start with the three-fund portfolio and adjust the bond portion to suit your risk level. Advantages of the three-fund portfolio:

- The three-fund investment portfolio is easy to understand.

- The three-fund portfolio generate good returns

- The portfolio is highly configurable if you want it to be.

After you picked your portfolio, go to your broker, and buy the recommended ETFs or mutual funds. If you need the correct allocation, you can use our rebalance tool.

That’s it! You’re on your way to mastering how to invest money and beating the best!

Now its time for a little talk about thinking long-term and keeping up your momentum.

Step 4: Using the power of automation

Whenever you can, you should take advantage of any way to automate your savings and investing setup.

At the very least, you should set up a recurrent transfer from your deposit account to a savings account to keep your savings separate from your “normal” income. Best of all is to send the savings amount to another account you do not look at regularly. It prevents you from dipping into it when you see how rich you have become!

The next thing you want to do is set up an automatic investment process. If your broker bank or mutual fund support automatic investment, make use of it (but check their fees first!) This is highly recommended! For U.S. residents, there are a lot of options for this: Vanguard, Schwab, and Fidelity offer this feature as does a lot of brokers. Automating the practicalities makes sure that your money does get invested regularly.

Step 5: How you go from beginner to investment guru

Now that you are on your way to reaching your goals, let’s make sure you stay on the path.

If you have set up an automated process for savings and even for investing your money, you are 95% done!

There are still a few things left to do:

- If you haven’t set up an automated investment process, set up an “investment day” in your calendar where you buy the funds for that month, it should take no more than 10 minutes.

- Rebalance once a year. Check this post on how you rebalance your portfolio. The act of rebalancing can give you more money while at the same time lowering the risk of your portfolio.

- Look at your account balance only when you need to. Fidelity made a study showing the best performing portfolios where the portfolios of dead clients and clients that had forgotten they had an account. A lesson to be learned: Don’t look at your portfolio balance because you will be biased for action if things don’t go the way you imagined them.

- When you check your account balance, do so with your goals in mind. Increase your savings if your investments haven’t turned out as expected. The worst that can happen is you over save (that’s a good thing).

- Read a few books on investing to further your investing knowledge. Go here for some good recommendations.

- Email me or, better yet, make a comment below if you have any questions – others have the same question.

And joy is, after all, the end of life. We do not live to eat and make money. We eat and make money to be able to live. That is what life means and what life is for.

–George Mallory