Is doing well by doing good more profitable? Do the good guys finish first?

We tested 174 standard portfolios against 174 comparable socially responsible investing (ESG) portfolios. These are the results.

Socially responsible investing(ESG) investing is investing in companies that address environmental, social, and corporate governance issues. You can read more about socially responsible investing (ESG) investing in our post ESG Investment Portfolios On Portfolio Einstein.

But how do you find out if socially responsible investing (ESG) investing it better?

One way of finding out is by measuring the stock price of socially responsible investing (ESG) companies. When you collect enough companies and wrap them up, you get an ETF or a mutual fund.

When you combine several ETFs, you get a portfolio. That’s where we come in.

Portfolioeinstein.com tracks both standard portfolios and socially responsible investing ESG portfolios. We track over 800 portfolios, so we are in a unique position to provide statistics on how ethical (ESG) portfolios do against standard vanilla non-ESG portfolios.

Article Contents

- Is socially responsible investing better? We tested 174 portfolios, here are the results

- Money talks – more money talks more

- Let’s set up the rules for testing

- The rules

- The data

- Portfolio performance standard vs. socially responsible investing

- 1 vs. 1, who did better?

- Ten selected portfolios

- What are the results

- What you should do with the data

- Conclusion

Portfolio Einstein recently released its first wave of ethical portfolios. We also released the portfolio allocation for the first ethical portfolio. We will document many more soon. We also released the best-in-class ETF list of socially responsible investing (ESG) ETFs. That list shows which ETFs you can use to replace your standard non-ESG ETFs.

In total, this makes it easy for you to invest in socially aware companies. It makes it easy for you to invest in ethical companies.

Studies show that socially responsible investing (ESG) investing holds less appeal for older generations than for the millennial generation. There are many reasons for this, and we touched on a few causes in our introductory post on ethical ESG investing.

But it comes down this: It is hard to change anyone’s mind as it probably should be. It is near impossible to do so over the internet as it should be. However, socially responsible investing (ESG) investing represents another tool in our toolbox to do something to join the cause in tackling environmental issues and social issues.

It is, therefore, worth exploring how we can convince the older generations to join the fray in socially responsible investing (ESG) investing. We want the older generations to participate in ethical investing because they command massively more investable assets than the Millenials do. That means they can make that much more of a difference when they invest.

Money talks – more money talks more

The best motivation to change your investing style is if you can receive higher returns following a different investing style. If we can get higher returns or at least comparable returns investing in socially aware and ethical companies, wouldn’t you want to change your investing style?

There are many more reasons for investing in socially aware companies, but one of the first significant hurdles is the return characteristics. If the investment is not profitable, the rest doesn’t matter. Or at least it wouldn’t be called an investment but charity.

To put it bluntly, money talks. Therefore socially responsible investing ESG investing needs to be profitable, following the capitalist ideal of the profit motive. If socially responsible investing ESG investing will make you lose the money, you will quickly give up on it as it is not itself sustainable.

“It is not from the benevolence of the butcher, the brewer, or the baker that we expect our dinner, but from their regard to their own self-interest. We address ourselves not to their humanity but to their self-love, and never talk to them of our own necessities, but of their advantages”

– Adam Smith from The Wealth of Nations.

Portrait of Adam Smith, author of The Wealth of Nations (1776)

Luckily socially responsible investing ESG investing has, in the past three years, been a great investment style. Let’s dive into it.

Let’s set up the rules for testing

Portfolio Einstein tracks hundreds of portfolios. You can see them on this page. We also track a lot of socially responsible investing ESG portfolios.

Throughout this post, we distinguish between the standard and socially responsible investing ESG portfolios.

By standard portfolios, we mean portfolios that are made up of ETFs that do not specifically favor high socially responsible investing ESG scoring companies. In the graphs below, standard portfolios will have a blue color.

By socially responsible investing ESG portfolios, we mean portfolios that are primarily made up of high scoring ESG companies (at least 75% of the portfolio). In the graphs below, standard portfolios will have a green color.

In our article on socially responsible investing ESG Investment Portfolios On Portfolio Einstein, you can find our methodology on how we select socially responsible investing investment portfolios. You can also read way more about what socially responsible investing is.

Here is our methodology in short: socially responsible investing portfolios are constructed by replacing standard ETFs with socially responsible investing ETFs for those asset classes that have an ETF that tracks high ESG scoring companies.

When we can replace 75% of a portfolio asset allocation with a socially responsible investing ETF, we select that portfolio as a socially responsible investing portfolio.

It is important to note that the asset allocation of a portfolio does not change just because it is a socially responsible investing ESG portfolio.

The asset allocation remains the same, whether it is a standard or a socially responsible investing ESG portfolio.

The rules

We have identified 174 socially responsible investing ESG portfolios on Portfolio Einstein.

We test the 174 socially responsible investing ESG portfolios against their standard counterparts.

We focus primarily on the returns and risk characteristics in the form of the drawdown of the portfolios.

We only have three years of backtesting data. It is not a lot of data, but it is a start.

In many of the data points, we create an average of all the portfolios. When we compare return data, we have averaged the returns for standard portfolios and socially responsible investing ESG portfolios and compared the results.

The data

Let’s first see how the socially responsible investing ESG ETFs have done in the past three years. The ETFs are the ones that we use to construct the portfolios. This means that if the ETFs have done poorly in comparison to their standard counterparts, then most likely, the socially responsible investing ESG portfolios will also do poorly. Diversification can only do so much.

At present, our selected socially responsible investing ETFs can replace eight asset classes. The asset classes are:

- Total US Market

- Large Cap Blend (S&P 500)

- Small-Cap Blend

- International Developed

- Emerging Markets

- Total Bond Market

- Short-Term Bonds

- Intermediate-Term Corporate Bond

Asset class performance

Let’s see how the eight asset classes have done in the years 2017-2019. Let’s also compare them to their socially responsible investing ESG counterparts.

The table below shows the return for the eight asset classes for both standard and socially responsible investing ESG. They are divided into years, so a comparison is easy.

The first thing we see is that standard and socially responsible investing ESG investing is very comparable! Within each year, there are only minor to medium differences in returns. However, small and medium differences can result in significant outcomes when taken over a lifetime of investing.

The asset classes we should pay a good deal of attention to are:

- Total US Market

- Large Cap Blend (S&P 500)

- International Developed

- Total Bond Market

This is because the four asset classes have a high frequency of appearance in the portfolios on this site. They also generally appear in greater weights than other asset classes. In other words, their frequency and impact are both higher than in other asset classes.

If we see a significant difference in returns of these asset classes between socially responsible investing and standard, the differences will trickle down into the portfolios.

In 2017 the Standard Large Cap Blend (S&P 500) won out over socially responsible investing by 0.72%.

In 2017 standard International developed won out over socially responsible investing by 1.28%.

In 2018 and 2019, the ethical ESG asset classes won both years for those same asset classes.

While they did not win by much, it quickly adds up over time.

Emerging markets had a strong year in 2017, but notice the strong performance of the socially responsible emerging market. Socially responsible investing won by 7.5%! In investing, that IS a lot.

But remember that thing about impact and frequency? While the asset class returns are high, the resulting returns of the portfolios are dampened. They have dampened because allocation to the emergings market is typically 5-15% of the entire portfolio, and not all portfolios have allocations to emergings markets. So the impact is not that great.

It should be noted that most of the asset classes have data going back to 2017. The impactful socially responsible investing aggregate bond market ETF was launched in October 2018 by iShares, so we only have data from that date. The missing data has been filled in from standard asset class return data.

Ok, let’s step it up a notch and see how the portfolios compare.

Portfolio performance standard vs. socially responsible investing

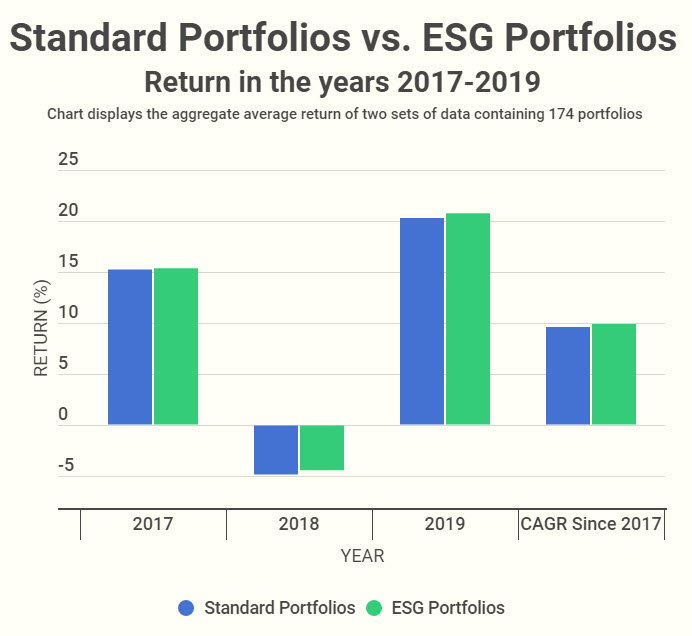

The first table displays the aggregate returns for each of the years 2017 – 2019 and compounded returns for 2017 – 2019 for both standard and ethical portfolios.

The above table shows how ethical portfolios, on average, beat out standard portfolios.

We see that the ethical portfolios have WON every single year over the standard portfolios. Over three years, it results in a 0.31% return advantage to the socially responsible investing ESG portfolios. Again, that may not sound like much, but over a lifetime, that will change your net worth considerably. See A half a percent that can change your retirement.

Notice also the slightly lower drawdown of the socially responsible investing ESG portfolios. You get higher returns and lower risk.

Here we have the same data displayed as a bar chart. It is easy to see the socially responsible investing ESG portfolio outperformance.

The chart displays the aggregate average return of 174 standard and ESG portfolios for the year 2017 – 2019. It also shows the compound return for the years 2017 – 2019.

The wins of the socially responsible investing ESG portfolios are made despite that the socially responsible investing ESG ETFs have higher expense ratios. Sometimes 3-5 times higher expense ratios. See the expense ratio of the ETFs used.

Over three years it results in a 0.31% return advantage to the socially responsible investing portfolios.

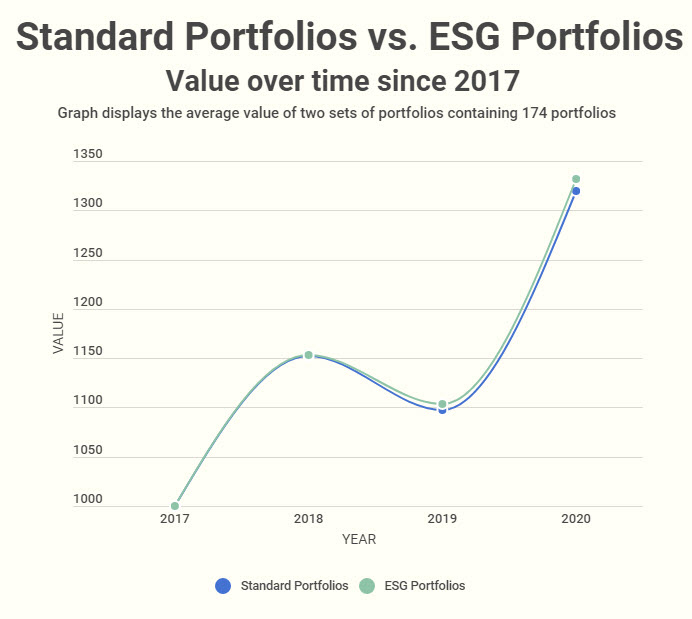

The line chart below displays the change in value if you had invested $1000 in 2017 in an average portfolio of the 174 socially responsible investing ESG and standard portfolios.

The chart display value increases over time of 174 standard and ESG portfolios.

We can see that the socially responsible investing ESG portfolios have a slight edge both in returns and a small edge risk in the form of a diminished drawdown.

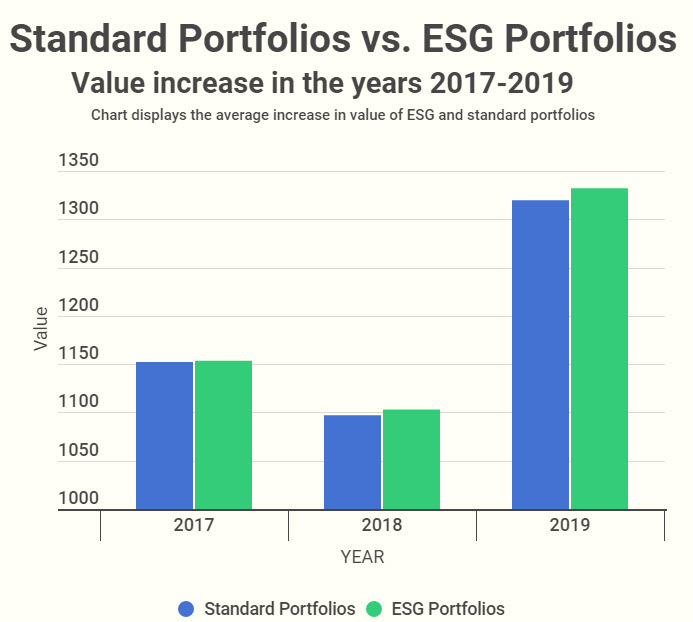

The chart displays the average increase in the value of 174 socially responsible investing ESG and standard portfolios.

From the above table, we can see that 2019 was a fantastic year to hold stocks. It was even a better year if you had held socially responsible investing ESG stocks – or a socially responsible investing ESG styled portfolio.

Let’s see how the portfolios have done each year when we compare them against each other.

1 vs. 1, who did better?

In the following, we display four charts. For each year, we have taken each portfolio from the standard portfolio and compared them to its counterpart socially responsible investing portfolio. The one with the highest return that year won. We then added up the results to get a picture of how often socially responsible investing portfolios win.

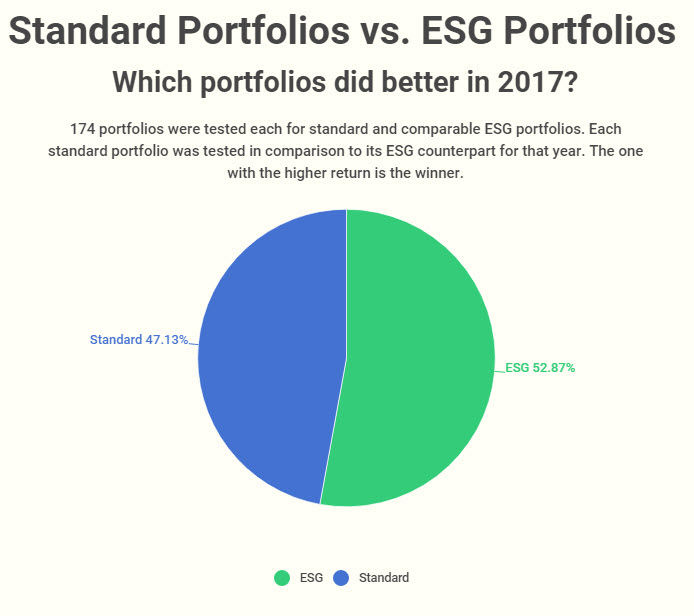

The chart displays the win/loss ratio of 174 standard portfolios vs. socially responsible investing ESG portfolios for the year 2017

In 2017 the two sets of portfolios were pretty much even. They each won almost as many wins. The standard portfolios won 47.13% of the time, while the socially responsible investing ESG portfolios won 52.87% of the time.

Let’s see for 2018 and 2019.

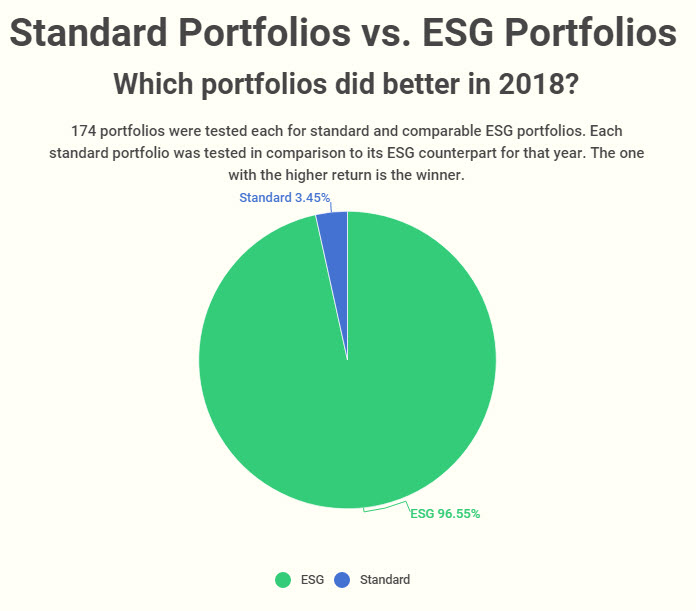

The chart displays the win/loss ratio of 174 standard portfolios vs. ESG portfolios for the year 2018

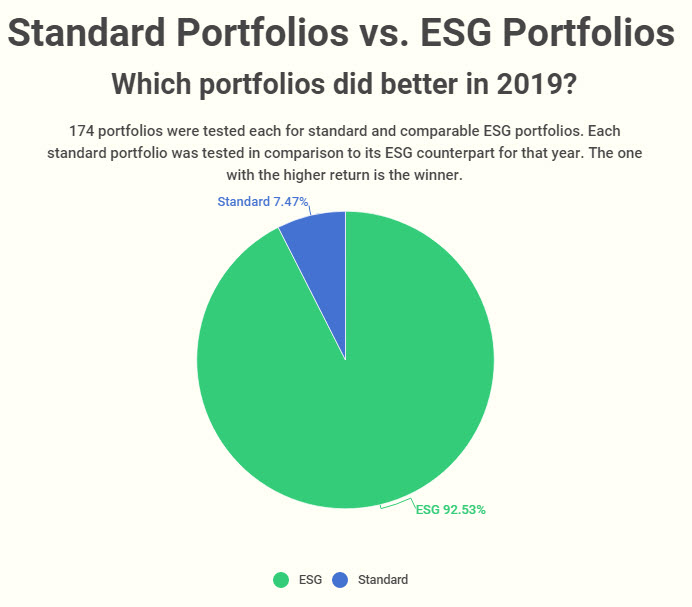

The chart displays the win/loss ratio of 174 standard portfolios vs. ESG portfolios for the year 2019

For 2018 and 2019, we see massive socially responsible investing portfolios wins over standard portfolios. It is not even close.

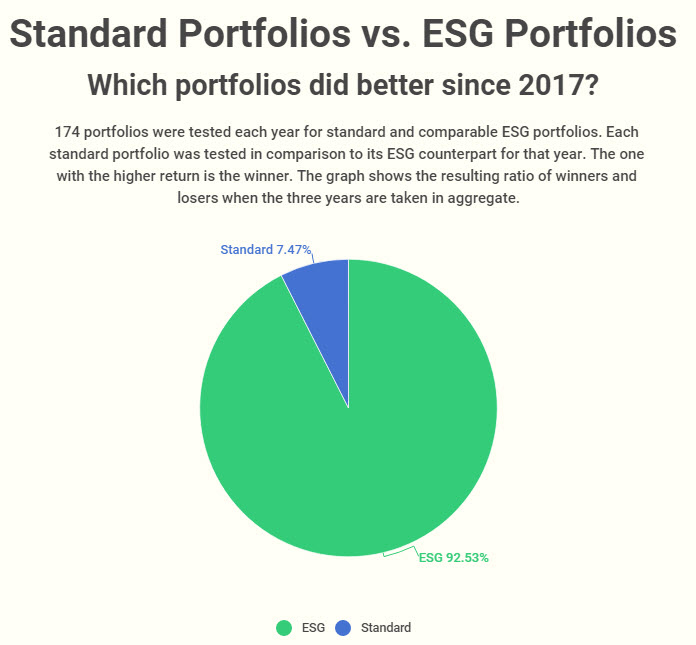

The chart below shows the results in aggregate.

The chart displays the aggregate win/loss ratio of 174 standard portfolios vs. ESG portfolios since 2017

The charts tell us that in 2018 and 2019, you would have done better return wise if your portfolio was invested in socially responsible investing enabled ETFs.

Let’s zoom in a little more.

Ten selected portfolios

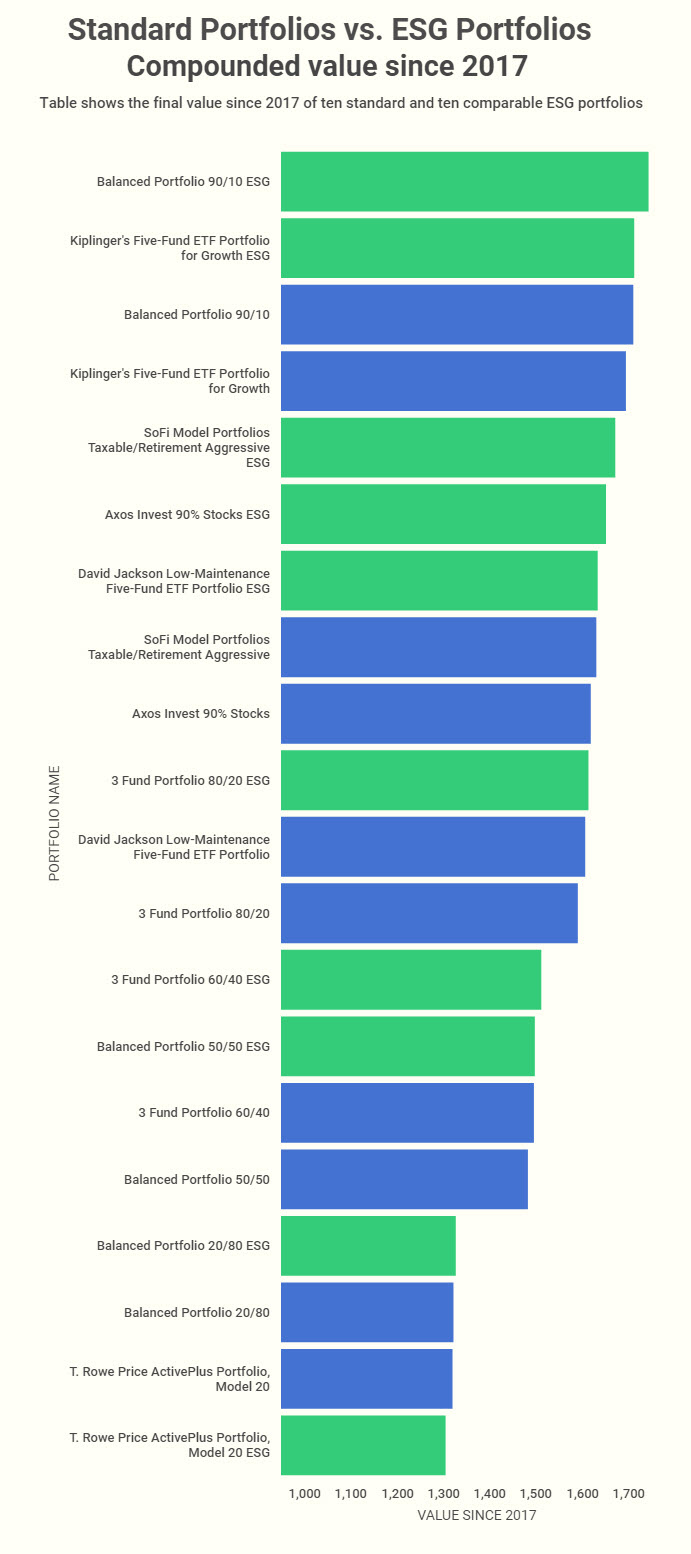

We have chosen ten portfolios and ranked them by their compound returns for 2017-2019. The portfolios selected have two asset classes up to nine asset classes in their portfolio, to get a representation of asset class mixes.

The table shows the compounded value of ten standard and ten comparable ESG portfolios ranked by the highest value by the end of 2019.

The table shows us that almost all of the ten standard portfolios lag behind their socially responsible investing ESG counterparts. It tells the same story as the aggregate win/loss graph.

What are the results

The results show that socially responsible investing ESG portfolios outperform standard portfolios on both returns and drawdown.

This should be fantastic news for anyone considering investing in socially responsible investing ETFs.

The asset class socially responsible investing ESG ETFs outperform their standard asset class counterparts for the most part but not conclusively.

It is worth noting that we only have three years of data on socially responsible investing ESG portfolios. That is by no means enough data to make any sort of predictions of the future of socially responsible investing ESG. What we can say, however, is that the data so far is hugely encouraging.

What you should do with the data

As stated in the introduction, there are many reasons why you should care about ethical investing.

Now you have one more reason to care. It is more profitable from a return perspective. That should get you motivated.

If you are still in doubt if you should invest in ethical companies, you could start by investing some of your next deposit in a socially responsible investing ESG ETF. You don’t have to commit 100% to a socially responsible investing ESG strategy.

You could shift 5% of your total US market into a socially responsible investing ESG ETF (ESGU), or you could do more. High ESG scoring companies are not that different from standard companies. The iShares ESG MSCI USA ETF (ESGU) is a broad market ETF that tracks high scoring socially responsible investing ESG companies.

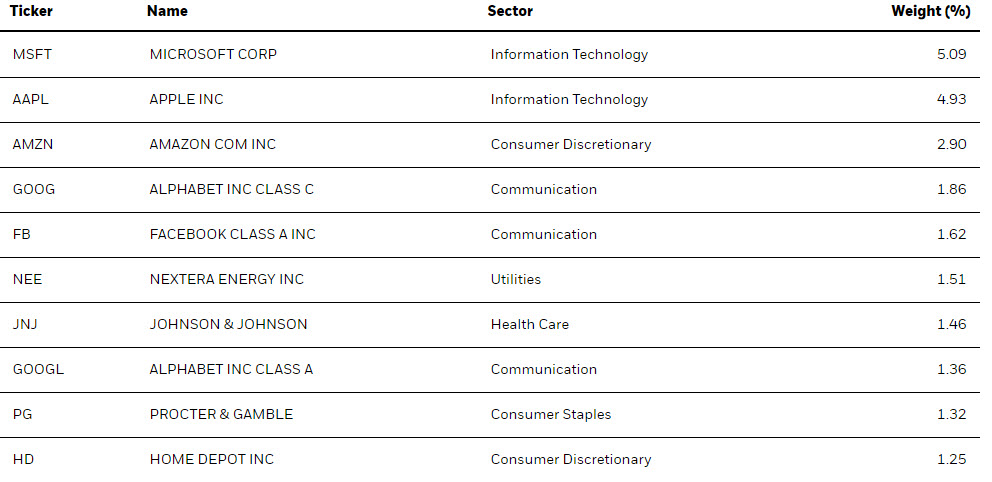

Here are the top 10 holdings for the ETF ESGU:

The Top 10 holding of the iShares ESG MSCI USA ETF (ESGU)

The beauty of socially responsible investing ESG investing is that you get the same returns and very often higher returns than from a standard portfolio.

But it gets better! At the same time, you are getting higher returns; you will also be supporting companies that try to help with environmental issues and social issues.

That sounds pretty darn good.

Conclusion

Socially responsible investing is quickly garnering traction, especially among the younger generation. The younger generation is more environmentally aware and socially conscious than previous generations.

In this article, we have shown that socially responsible investing portfolios outperform their standard counterpart portfolios most of the time. Not by a lot, but if the outperformance persists, it will create a significant difference that will impact your net worth substantially.

There is no reason not to shift some of your portfolio allocations to a socially responsible investment asset allocation. Based on historical data, you could get a higher return (beware though: past is not indicative of future results). But more importantly, you could also chance to make a difference by not choosing to invest in low ESG scoring companies. In any case, you will not have an impact on solving our environmental and social issues if you do nothing.

Next actions for you:

If you know anyone that considers a socially responsible investment, send them this post to show them the current data on the topic.

If you know any baby boomers (Born 1946 – 1964) or g****eneration X’ers born 1965 – 1976 or anyone from the **s****ilent generation (**born 1945 and before), be sure to send them a link to this article!

If you have a portfolio that you want to convert into a socially responsible investment portfolio but don’t know how then post it in the comments, and we’ll help you! If you use a portfolio from us that we have not ESG’ed, be sure to tell us in the comments, and we will push that portfolio to the front of the queue.